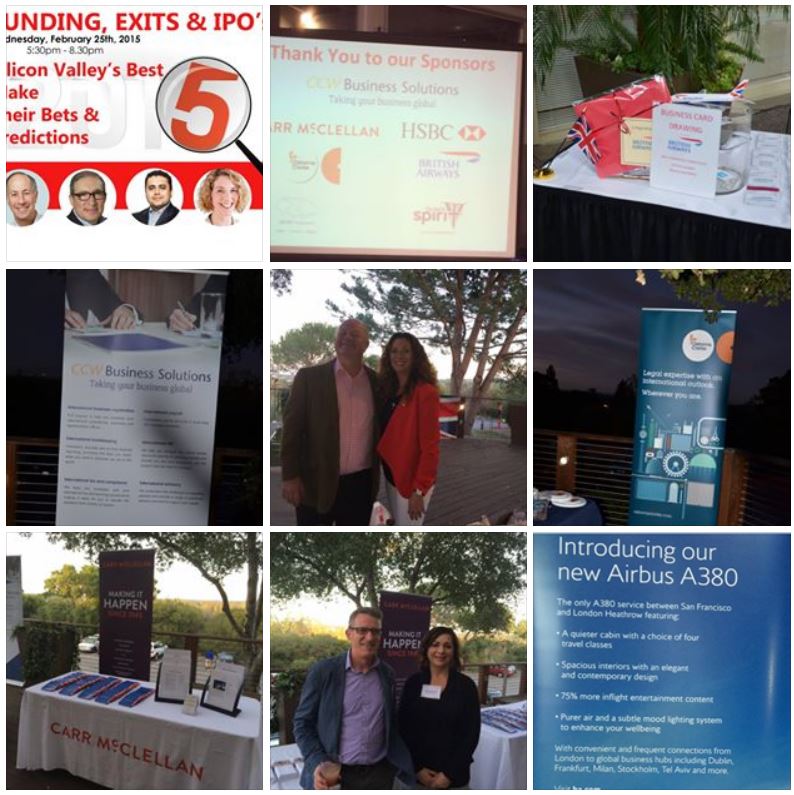

BABC Northern California hosted its 4

th Annual “Funding, Exits and IPO’s” event on February 25th, 2015 where we were pleased to welcome over 90 guests who gathered to learn the views and predictions for the year ahead from our esteemed panel of Silicon Valley’s leading venture capitalists. Our thanks to all the attendees for your wonderful and enthusiastic support and of course our incredible panelists – Steve Goldberg, Managing Director of Venrock, Mitchell Kertzman, Managing Director of Hummer Winblad Venture Partners, Gaurav Tewari, Managing Director of Sapphire Ventures, Sharon Wienbar, Managing Director of Scale Venture Partners and . Richard Waters, West Coast Editor of the Financial Times for a highly insightful and entertaining perspective.

Throughout the evening our panelists drew upon their wealth of collective experience to offer invaluable guidance into the world of venture capitalism. Mitchel Kertzman strongly exhorted risk analysis, and lamented the worrying trend of companies opting to go public without sufficient analysis of the risks involved. Sharon Wienbar further noted that technology’s disruption of mainstream consumer markets caused the sudden boom in growth, causing many investors to overstate their valuations, leading to an unnatural growth rate.

Gaurav Tewari elaborated Sharon’s point, stating that Government incentivisation for growth through low interest rates has created a surplus of capital which is disproportionate to the number of successful ideas that exist. Mitchell Kertzman stated that “[The] Overfunding of categories takes away the Darwinian aspect of business … [a] surplus of capital leads to overspending”. He opined that companies are spending for growth, humourously quipping the eventual ‘bloodbath’ that will arise when they struggle to cope with the inevitable deceleration of growth.

All of the panel put themselves forward in making some very bold predictions for the upcoming year addressing any the potential formation of new IPO’s over the next year, comparing the German automotive industry to that of Silicon Valley and, of course, whether or not the boom will still be in its ascension at this time next year.

The BABC would like to thank all of those who made the event such a fantastic occasion! These include our sponsors: